Issue 16

June 2020

The first question anyone asks me these days is what do I think about the rebound in the market. The follow-up question is what should I do or what do I think the market will do next. The short answer is I do not know. And I would be very leery of anyone telling you they know what is going to happen next.

Here are a couple ideas to consider for why the market has reacted the way it has. First, the government has shown a decisive (by Washington standards at least) willingness to financially support the economy through the Crisis. Second, the Federal Reserve authorized purchases of various debt instruments, which increased liquidity and reduced risk. You can agree or disagree with these ideas. That’s what makes a market! Sidenote, this is a key reason I invest in individual companies. It allows me to focus on finding businesses at a reasonable valuation, strong competitive positions, and the ability to increase earnings over the next 5-7 years rather than the what and why in regards to stock market movements.

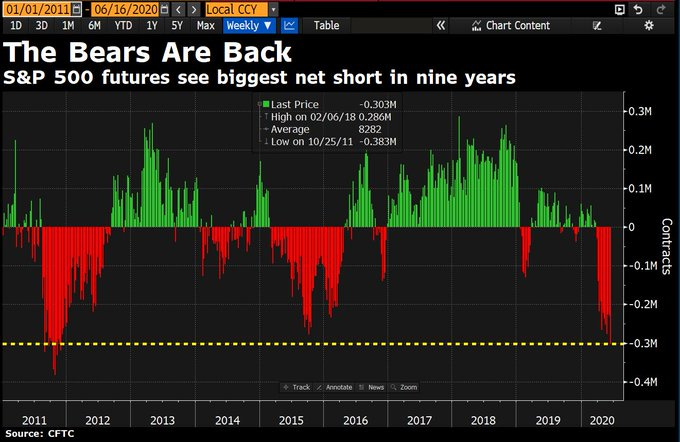

And just because the market is up a lot doesn’t mean everyone expects the trend to continue. Below is a chart showing a 9-year high interest from investors betting the market will go down. If you expect the market to decline in the coming months, then you aren’t being contrarian. It is more consensus than at any other point since 2011 to bet the market will fall. That doesn’t mean the market won’t fall. It very well could. Just be aware many people are placing a similar bet.

To that end is the question of what should you do? The first thing I would recommend you do is reach out to me and schedule some time to chat. My email is bill@springcitypartners.com.

The second thing I would recommend is don’t try to time the market. You can’t. Instead, create a plan and stick to it.

Below is a snippet of my personal investing journal from 4/7/20. I think it highlights why investing is so difficult when making decisions based on short-term variables.

At this point hard to feel confident either way between bullish/bearish. Don't see earning season as a real catalyst. Hard to imagine businesses will have a ton of visibility about Quarter and Annual outlook in the next 2-3 weeks. On the flipside, market is still down 15% and government has shown a willingness to try and bridge the financial gap.

Since then S&P 500 is up ~10%. What does this teach me? That I can’t predict or insulate myself from the movement of stocks in the short-term. Instead I must remember that volatility ≠ risk and focus on what is important for my investment process. Long-term results.

The chart above shows the 10-year return if you invested in the S&P 500 during October 2007. This represented the highs before the Global Financial Crisis. This chart serves as a reminder to extend your investment horizon. If timing or current market outlook is holding you back from investing, then take a stepback. Create some long-term goals. Even if you picked the absolute worst moment to invest in 2007, you still would have doubled your money over the next decade. When placed in the context of today, I am reminded of the Mark Twain quote, “history doesn’t repeat, but it does rhyme.”