In my last newsletter I hinted at a big announcement. Well here it is!

The motto for Spring City Partners is Where Wall Street Knowledge meets Main Street Values. That is my north star. After having numerous conversations, I have realized my existing model was probably a little too Wall Street and not enough Main Street. With that as my guidepost, I am excited to launch the Keystone Fund! A basket of rules-based (passive) investments meant to provide diversified exposure to the global markets via ETFs and/or mutual funds.

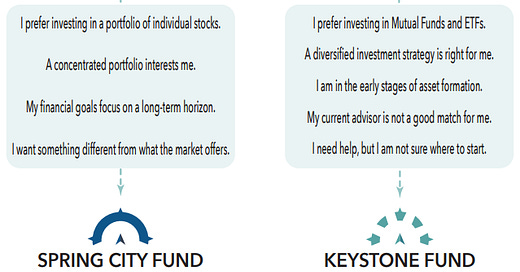

Moving forward partners will have the ability to allocate their assets into two different funds: Spring City Fund and Keystone Fund.

There is a famous business framework in venture capital called product-market-fit. I believe the first two components are controllable. You create a product and have a target market. The uncertainty lies in whether the market will be receptive to your product. When I launched two years ago with the Spring City Fund (Product), I was targeting the Main Street (market). Having added 18 partners since launch gives me confidence I am resonating with folks. However, I think there is an opportunity for me to do more. Enter the Keystone Fund!

By offering both active (Spring City Fund) and passive (Keystone Fund), I can provide a product that fits the needs of every single reader of this newsletter. Importantly these are not mutually exclusive products. Interested in just the Spring City Fund? Great! Interested in just the Keystone Fund? Awesome! Interested in both? Fantastic! I want to make it as easy as possible for you to reach your long-term financials.

The easiest way to reach your long-term financial goals is to get started today. With many of my initial 18 partners being peers of mine, I want to highlight the power of saving and investing today. The below graph shows the difference between saving $5,000 per year starting at age 30 and 40. Each simulation assumes 7.0% growth per year.

As the chart highlights the earlier you start, the more you will save. That’s pretty obvious. However, the sheer power of compounding is important to quantify. The amount saved varies by $50,000, however, the outcome is $401,185 apart($744,567 for age 30 and $343,382 for age 40). That’s a massive gap! The implication being, by investing $50,000 throughout your 30s you will make 8x on that investment over the next 35 years.

Need help starting your financial journey? On the right path, but want guidance on how to maximize your investing potential? In the later stages and looking to protect your hard-earned savings? Please reach out and schedule a time to chat.