This week marks the one year anniversary of SPY (ETF tracking the S&P 500) bottoming at ~$215 per share (+82% since the bottom). A lot has changed in our lives over the last twelve months. Hopefully the next twelve months bring about changes that allow us to return to a more normal world. One thing that will not change, is my investing process and belief in holding a concentrated portfolio of individual companies with the goal of generating double-digit annual returns. For my partners, those who have entrusted me to invest their assets, they have seen the benefit of this strategy over the last few years.

I want to take this issue to use a real investment from 2020 to highlight the risks and potential rewards associated with a portfolio of concentrated investments.

——————————————————————————————————————

First, and most importantly, owning a small number of companies allows me to spend the majority of my time truly understanding the businesses I own. This sounds logical, but is practiced by few investors. Instead the majority of assets are invested in passive strategies mimicking the broader market or active strategies focused on generating short-term results.

For everyone following crypto and WSB, I would characterize these participants as paper hands, which is slang for people lacking conviction to hold an investment if the price goes against them. My strategy requires me to have diamond hands, which requires you to have conviction in the long-term value of an investment to hold it through a massive decline. 2020 provided an opportunity to prove my conviction and the benefits of my investment strategy.

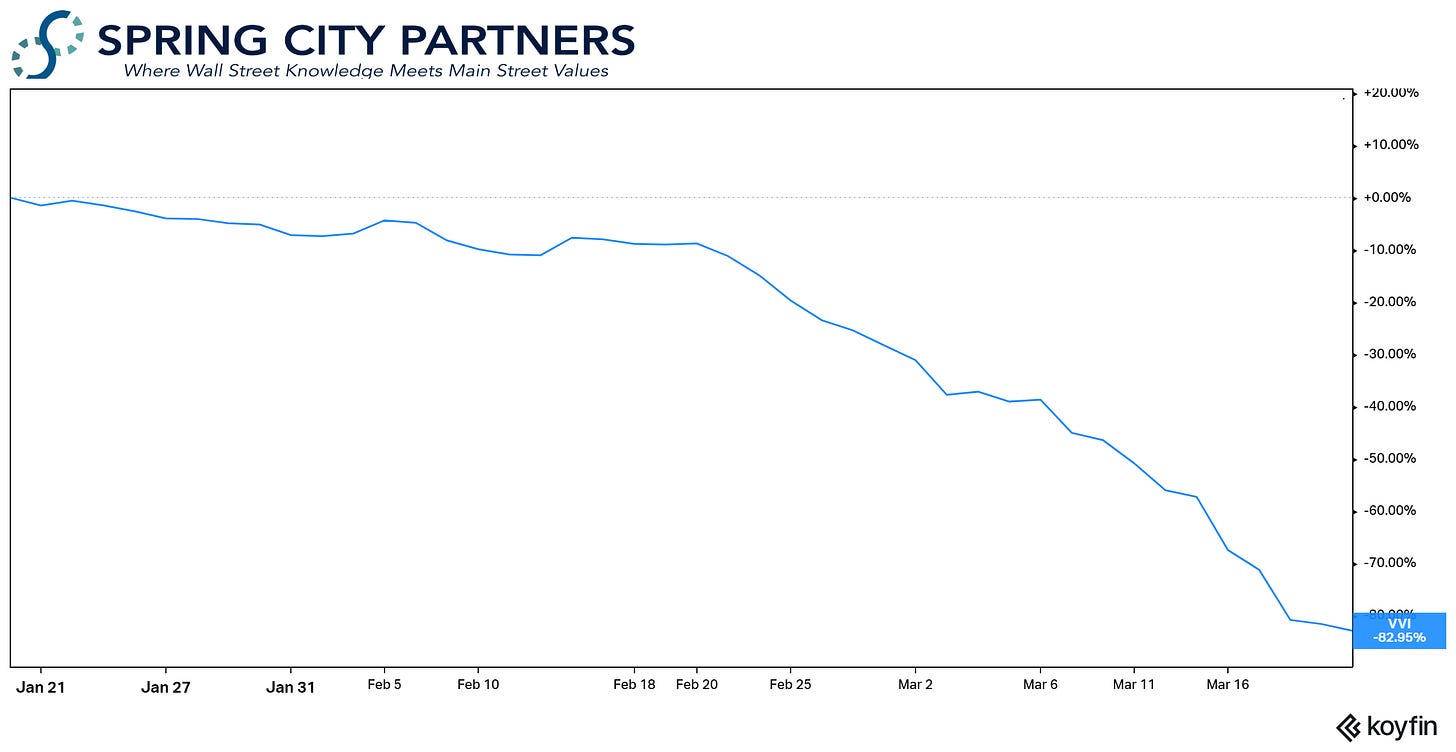

From the end of January until the middle of March one of my largest holdings declined >80%. At that point I had three options: Sell, Buy, Hold. I decided to make a small purchase in March.

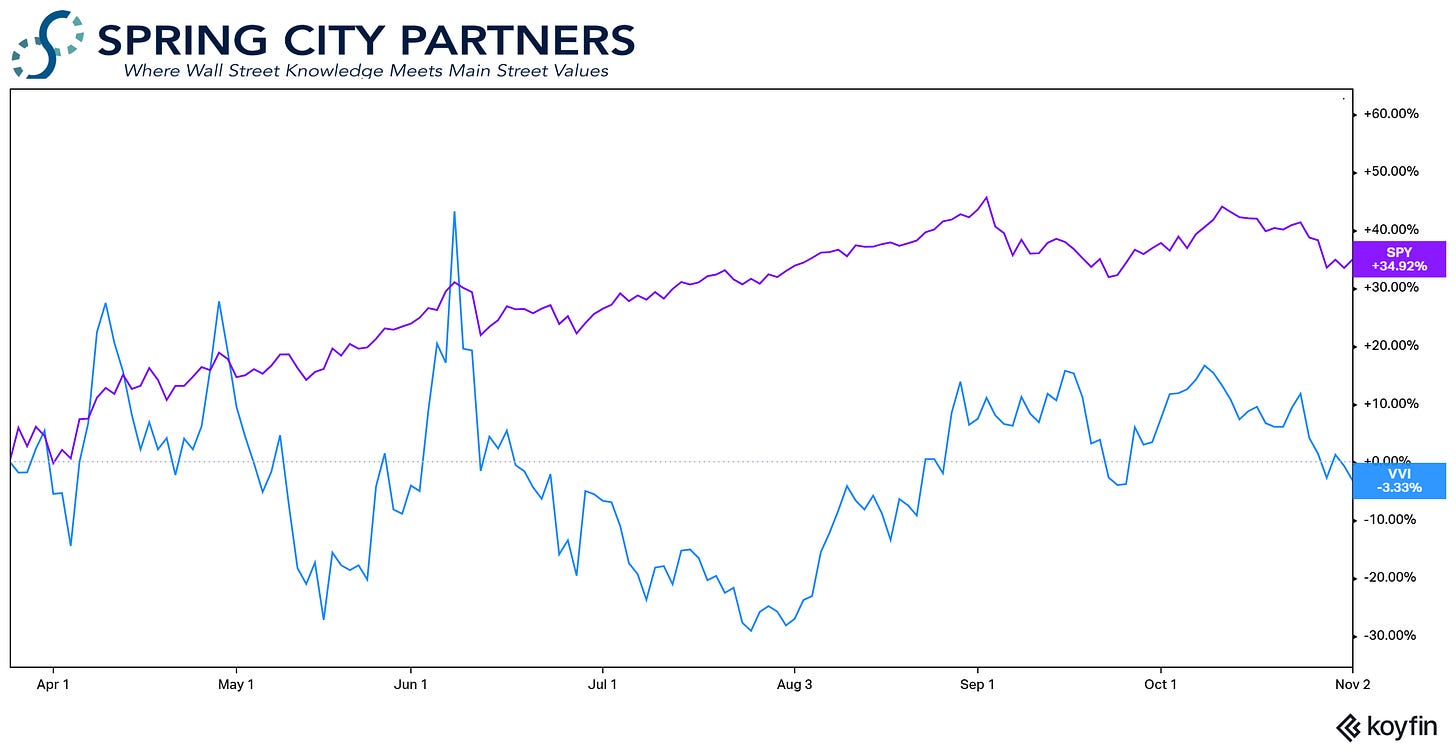

As you can see in the chart below, that proved to be a poorly timed decision. While the stock market raced higher over the summer months, this position languished. Despite having a firm understanding of the business and confidence in management’s ability to navigate COVID-19, the market didn’t seem to care about the value I saw in VVI.

During this period of neglect, I completed additional research and materially increased the position size. This was really hard to do. At the time I felt like a complete idiot. A stock I thought was so great had declined by 80%. To add insult to injury, the rest of the market saw rapid price appreciation. Fortunately, I focused on my research process and maintained conviction that the market was overlooking the long-term outlook for VVI.

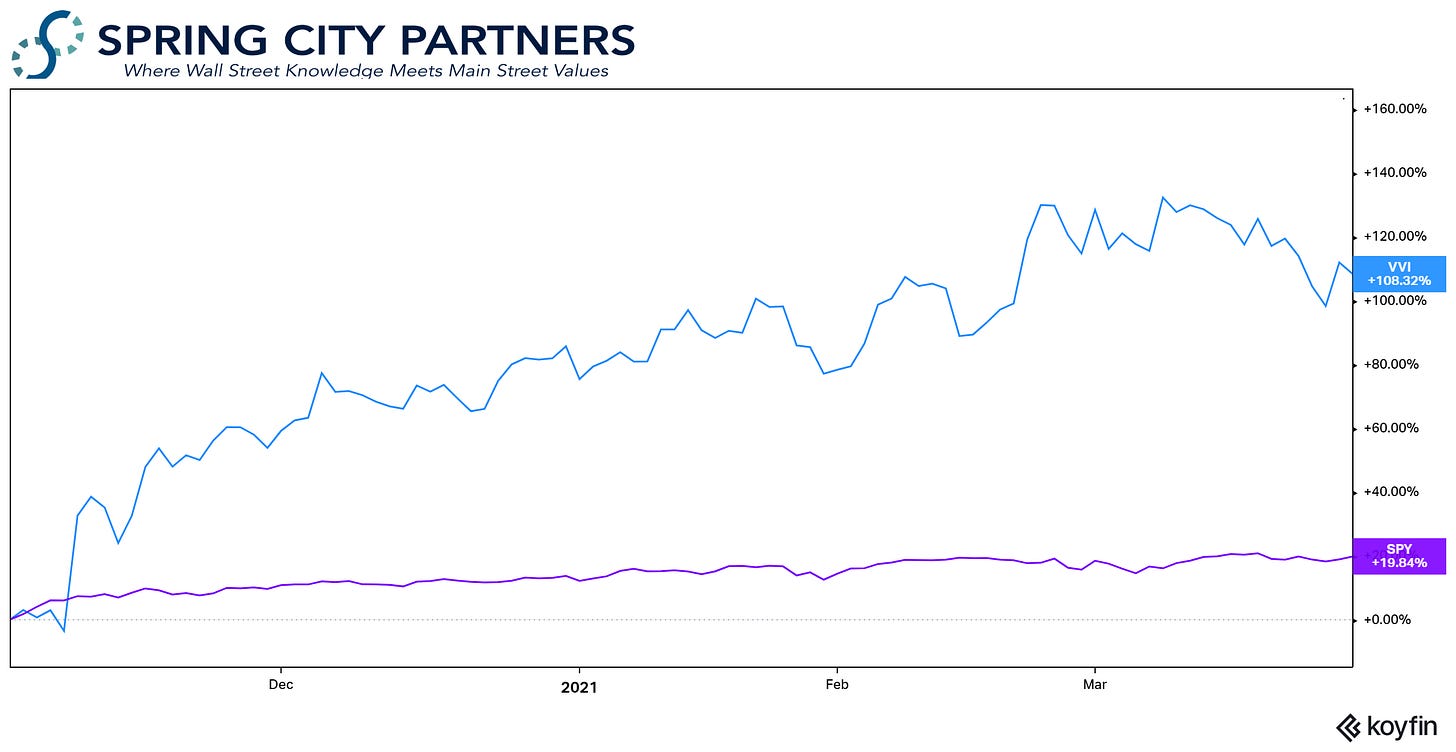

Once we received positive news about vaccines, supply, and subsequent distribution, the stock has gone on a massive run. As you can see in the chart below, it has doubled since early November. Helping to erase the pain from the first three quarters of 2020.

I’m not writing about this experience in an effort to brag about how much VVI has gone up. Unfortunately, it went down a lot first! Rather, I want to provide a window into a real life example of a position in the portfolio and how I managed it. Experiences like this give me confidence in my ability to navigate investments through periods of extreme volatility. Furthermore, it reinforces my need for partners who understand the risk and potential rewards with this strategy. It is a lot easier to have diamond hands when investments are going up. It is much more difficult to maintain that level of belief when something you own declines by 80% in the span of 7 weeks.

If you are interested in learning more about SCP and my investing strategy, please reach out.