In the short-run, the market is like a voting machine — tallying up which firms are popular and unpopular. But in the long run, the market is like a weighing machine — assessing the substance of a company. - Benjamin Graham

Here is a live look at how the voting has played out for the markets in 2022 …

The S&P 500 is firmly in a bear market declining by ~25% since the beginning of the year. The more tech oriented NASDAQ index has declined ~35% YTD. As I talked about in my last newsletter there are a lot of near-term risks and uncertainty dominating the narrative around the markets. Most importantly has been the markets focus on macroeconomic factors and Fed commentary. Everyone is focused on the Fed meeting in November and whether they will raise rates by 50bps (0.50%) or 75bps (0.75%). However, if we can take a step back and think about what investing represents we can see why these moments historically have proven to be very good times to invest. Don’t believe me?

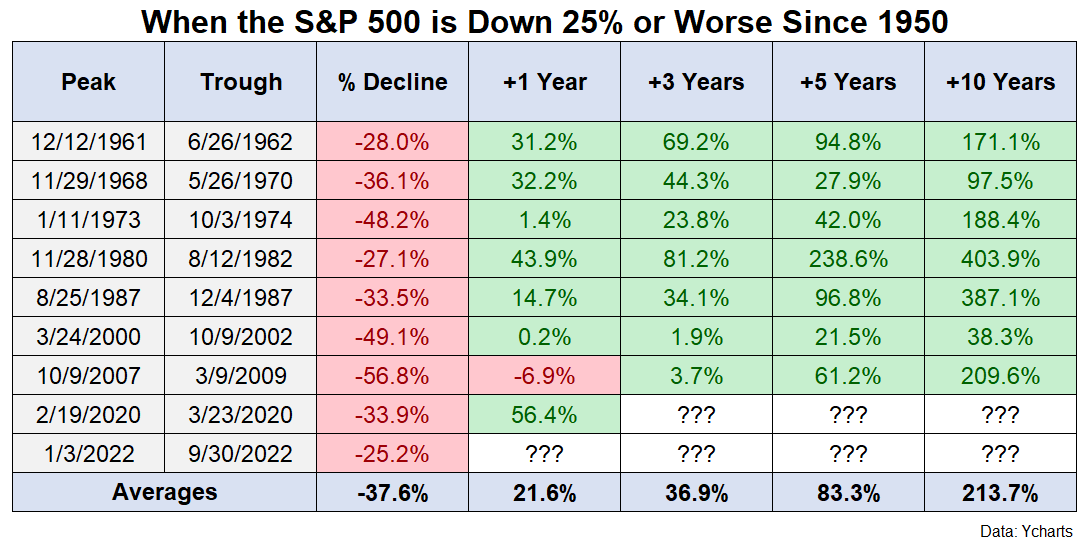

Here is data from Ben Carlson, showing future returns after the S&P 500 has declined by 25%.

Only once in the last 50 years has the S&P 500 been lower one year after it declined by 25%. In that scenario is was down 6.9%. In every other scenario the market has been higher after one year with the 3-5-10 year returns being significantly higher. Importantly, each of these 3-5-10 year returns is >11%. Simply put, investing during periods of turmoil have generated significant excess returns over the S&P 500 long-run average of 7-8%.

Now let’s think about why this is the case?

Investing represents purchasing a fractional ownership of a business today in the belief it will be worth more at a future date. There are two factors driving the future value: earnings (or any financial metric you want to use) and multiple.

When it comes to earnings, good businesses find a way to navigate through the economic turmoil insulating the impact on earnings. They take market share from weak competitors, more efficiently utilize existing assets, use excess cash to buyback shares at attractive prices, etc.

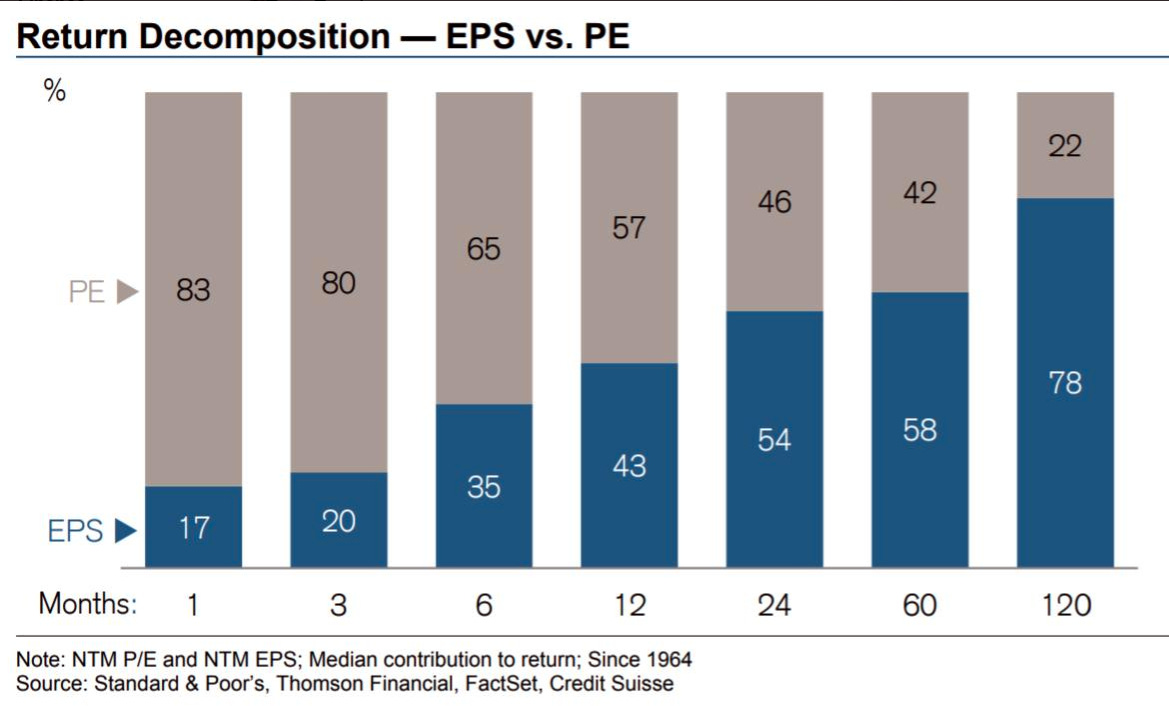

When it comes to multiples, those are outside of our control. They are largely driven by the prevailing interest rate and sentiment. Lucky for us, the majority of long-term returns aren’t derived by changes in multiple. A study by Credit Suisse shows that 78% of returns over ten years is driven by EPS growth. On the flipside, the majority of short-term (1-12 months) returns is driven by changes in valuation.

It is incredibly difficult to accept that short-term returns of your investments will be driven by factors over which you have very little control. However, it is why having a financial plan and long-term investment strategy are so important. They allow you to act like a great business, taking advantage of dislocations in the market, capitalizing on the irrationality of others, to create superior long-term returns for yourself.

Historically, periods of economic turmoil like today have ushered in periods of strong future returns. If interested in taking advantage of this current environment by beginning your investing journey or updating your existing plan, please reach out. As Winston Churchill famously said, “Don’t let a good crisis go to waste.”

Bill