Issue 38:

October 2022

There is a lot of focus on macro factors driving the stock market. Instead of talking about that, I want to provide some insight into my research process. By following companies over a long period of time, I am able to find and track unique data sets that give me insight into how a company is performing. Building up these resources is incredibly important to long-term investing because so much of the short-term moves in the stock market are decoupled from business fundamentals. Having data to track fundamentals helps decipher signal v. noise.

The following is a lightly edited version of an email I sent to my partners over the summer.

I want to change things up from writing about negative things happening at the businesses we own. In this one I'll provide a brief update on why things at VVI (Viad) are likely progressing better than the market is anticipating, specifically within their GES segment.

As you can see in the chart below, Viad had seen a substantial decline in price year-to-date.

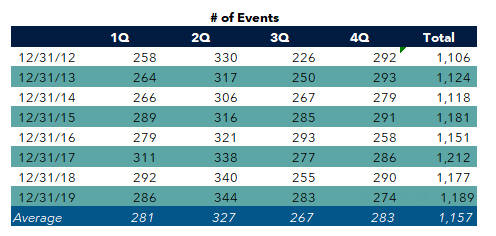

One of the advantages of long-term investing is you can build up knowledge/resources to help sanity check your investing thesis. To that end, I have records of every U.S. GES event put on going back to 2012. This is the table for pre-COVID.

Having this data provides me real time updates to the estimated # of shows GES puts on each quarter. I can use the quarterly show count to estimate Revenue per show.

The company put on 230 shows in 2Q22 and already has 157 shows booked for 3Q.

We know:

U.S. GES put on ~230 shows in 2Q22.

The historical Revenue range per show is $640,000-733,000.

This provides a Revenue range of $147m to $168m

GES EMEA (everything outside of the U.S) historically has similar Revenues per show. However, 1Q22 saw dramatically lower Revenue per show. For conservatism, let's assume even lower Revenue per show. GES EMEA should generate >$65m of Revenue.

This means combined GES should generate >$220m of Revenue, which should translate to $13-17m of EBITDA.

This compares to the following guidance from management on the 1Q call:

GES will generate $8-12m of EBITDA in 2Q and $25-35m for the full year.

If my data is correct, VVI should be well on their way to surpassing the guidance they provided in early May.

Further supporting this thesis is the results from Informa who delivers 100s of shows for B-2-B. In their earnings this week they said, "The strength of outperformance we are seeing in Live & On-Demand Events where markets are fully open and within ourB2B Digital Service offering provides a strong counterbalance to the short-term uncertainty in Mainland China.

Fast-forward to earnings from Viad on 8/4/22:

Results at GES far exceeded management guidance with Revenue of $241.6m and EBITDA of $35.1m. Fortunately for us, we had a high conviction this was going to take place and didn’t sell our shares at depressed levels. The share price responded to this earnings beat with a dramatic increase over the following month.

I know I can't predict near-term movements in the stock market or any of the businesses that we own. Instead, this exercise illustrates how/why sometimes movement in the stock market or prices of the business we own can become decoupled from the fundamentals. When that happens, we need to trust the processes we followed to guide our investment decisions. That spans creating the right plan for you all to be comfortable investing your hard-earned money in these positions AND me ensuring I am doing everything I can to deliver the types of returns we want to make over the long-term.

With the new year approaching and high levels of volatility, now represents a fantastic time to evaluate your financial plan. Are you doing everything you can to reach your long-term goals? If the answer isn’t yes, you know where to reach me.

Bill