I took a couple month hiatus from the newsletter. Mainly because I didn’t have a topic/idea that seemed particularly interesting to share. Fast-forward two months and a lot has changed both in the markets and society. One thing that hasn’t changed is my beliefs. I know I am a broken record, but the ability to think and own investments with a long-term horizon is literally the greatest power we possess when it comes to finance.

The market has seen a rollercoaster of narratives over the last six months. Anyone remember Omicron??? With COVID looking like it is finally in the rearview mirror, the market moved on to fears about inflation, interest rates, and the economy. Fast-forward to February 24 and Russia began an invasion of Ukraine. All of these events have served to fundamentally change the investing narrative. As Mike Tyson so eloquently put it, “Everyone has a plan, until they get punched in the mouth.”

Having a plan doesn’t eliminate the risks/volatility that comes with investing. Instead, it creates the framework allowing you to navigate through the turmoil. First, it creates a north star so you can ignore the noise of short-term events. Second, it allows you to capitalize on the change in market sentiment. I really like this saying about the psychology of investing. “At the top everyone’s investing horizon is infinite. At the bottom it is infinitesimal.” When the market goes down most people choose flight over fight. By shifting our horizon, we can take advantage of attractive prices for many of the companies we own.

So what am I doing today that is different than six months ago? Not a lot.

My north star is the same. Own really good businesses with strong fundamental outlooks, trading at reasonable valuation. Hopefully these businesses can generate double-digit returns in the coming years.

What am I doing to take advantage of the change in sentiment? In my January 2021 issue, I talked about the dashboard I have tracking my portfolio and watchlist. Additionally, I have another database tracking every investment decision made since launching Spring City Partners in July 2018.

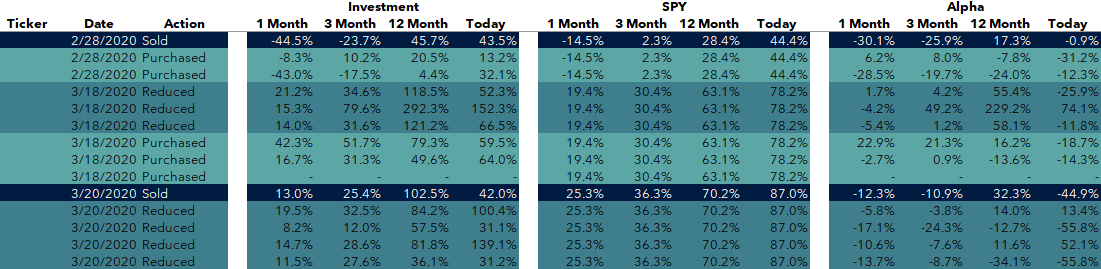

The below chart is a snapshot of the decisions I made during February and March of 2020, the height of market fear over COVID-19. As you can see, most of the decision I made proved to be sub-optimal choices. While I didn’t make a lot of decisions, the ones I did make were not great. My two biggest takeaways from reflecting on this period, were I need to do even less buying/selling and concentrate in your best ideas.

First, making decisions in moments of panic very rarely work in your favor. Be patient. Let the market panic create opportunities you can’t resist.

Secondly, when shit hits the fan there is a tendency to want to diversify. Unfortunately the grass isn’t always greener. I made four new investments during COVID. Only one of them outperformed the market over the next 12 months. A .250 batting average might be okay in baseball, but it doesn’t cut it investing. I would have been much much much better off concentrating in my highest conviction ideas. If you own a great business, with awesome management, secular growth, and you know more about it than most investors in the world these are the times to double down. Not diversify. It will make for a bumpier short-term, but pay dividends in the future.

In next month’s issue I am going to explain how the current market environment and compensation package for a new CEO led me to recently double-down on an existing position.

Bill