I’m sending this newsletter out a little late because I wanted to enjoy the holidays with family and refresh after a busy 2020! In this issue I am going to discuss progress made at SCP, thoughts on the current market, and what to expect from me as we head into 2021. ____________________________________________________________________________

Firm Accomplishments

Added six Partners bringing total to seventeen.

Assets under management exceed $5m.

Assisted three Partners rollover 401Ks from previous Employer into an IRA.

If you are like most people and have an old 401K floating around from a prior employer, please reach out! These are my favorite type of assets to manage. I can work with you to consolidate them and reduce your fees!

Launched the Keystone Fund

____________________________________________________________________________

Thoughts on the Market

Throughout 2020, but even more recently, I have spoken to a number of people about the markets. By and large their response can be summed up in a word, flabbergasted. The enthusiasm for IPOs and SPACs has to seem like deja vu of the dot-com bubble. The S&P 500 saw returns greater than 10% in both April and November. At this point I think the FOMO on future gains combined with past results leaves people uncertain on what is the best way to proceed.

Which leads me to an important point I want to discuss, market timing. The biggest pushback I get from people is the market just went up a lot, I don’t know if now is the right time to invest. This is a pretty common line and something I think about a lot, especially considering my entire livelihood is dependent on investing assets on behalf of my partners.

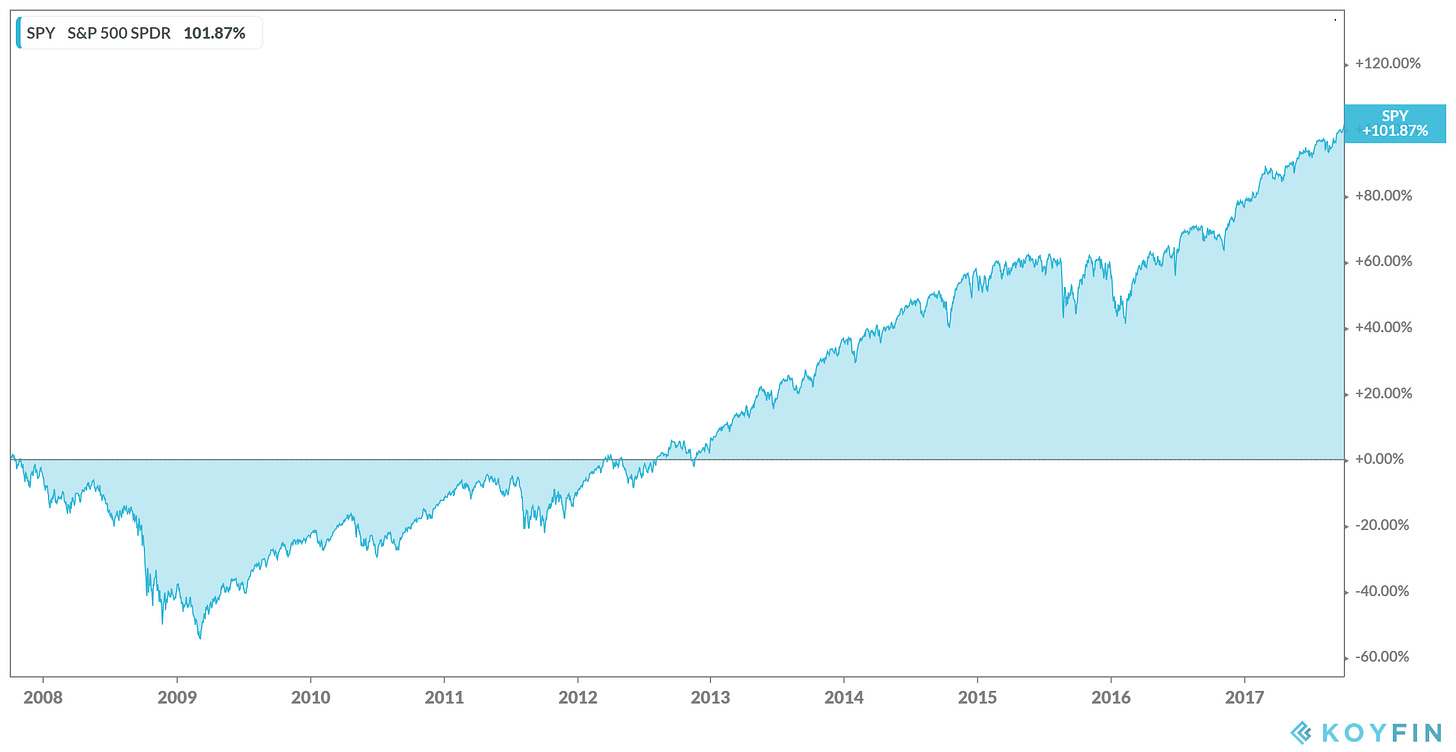

In my June 2020 issue I highlighted just how difficult it is to time the market by pointing out if you invested at the top of the market in 2007, you would have doubled your money over the following decade.

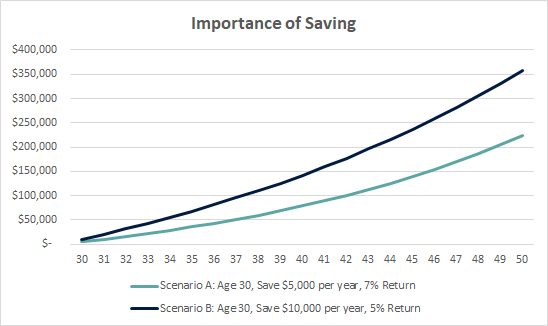

Asking if now is the right time to invest in the market is the incorrect way to frame the decision. Instead you should think about whether you are accumulating or harvesting assets. The reason being asset accumulation will be driven more by savings, than on your rate of return. The chart below illustrates the difference between savings rates and investment returns from age 30 to 50.

As you can see in the chart, the ability to save more money compensates for the higher returns of someone who saved less money. Despite returning 7% per year (40% higher than Scenario B), Scenario A ends with $224,326. Scenario B ends with $357,193 (60% higher than Scenario A) based on the higher savings rate. The importance of this chart can’t be understated for younger people early in their investing journey. Recognize your goal isn’t to perfectly time each investment. Instead, you should be focused on having a plan and sticking to it.

For someone in the position of harvesting assets, the decision making process is more complicated and personalized. I’d rather not make a blanket statement about that. However, if you or someone you know (like a parent) is contemplating retiring, I would be happy to have a conversation.

____________________________________________________________________________

Looking Forward to 2021

I have spent the past couple years trying to explain the importance of saving, investing, and thinking about these topics with a focus on the long-term. That won’t change. However, in 2021 I plan to spend a lot more time discussing stocks, portfolio construction, and some case studies from 2020.

I appreciate you taking the time to read this. I look forward to more conversations as we begin 2021!

Bill