Issue 42

Playing the Ponies

My last issue highlighted the divergence we have seen in the market to start 2023. I want to expand on the importance of this dynamic as it relates to investments and potential returns. With the Belmont Stakes this weekend, I find horse betting, also known as handicapping, to be an apt analogy for investing in the markets.

Horse betting operates on a pari-mutuel system, a term derived from French, which means mutual betting. In this system, the odds are determined by the bettors themselves. Initially, there is a morning line that offers an indication of how the track handicapper predicts the distribution of bets. However, the final odds are ultimately determined by the amount of money wagered on each horse. The more money placed on a particular horse, the lower the odds (and subsequent payout) become.

I believe that the stock market functions in a similar manner, albeit with valuations instead of odds. Just as bettors flock to their favorite horse, the higher the number of investors selecting a stock, the higher its valuation, resulting in a lower potential payout. Astute horse bettors, commonly known as handicappers, don't aim to bet on the horse most likely to win. Instead, they seek out horses whose odds are significantly mispriced. If they believe a horse is likely to win 1 out of 10 races but is being priced as if it would win only 1 out of 20 races, they perceive that as an opportunity worth betting on. We can draw parallels between this approach and the stock market.

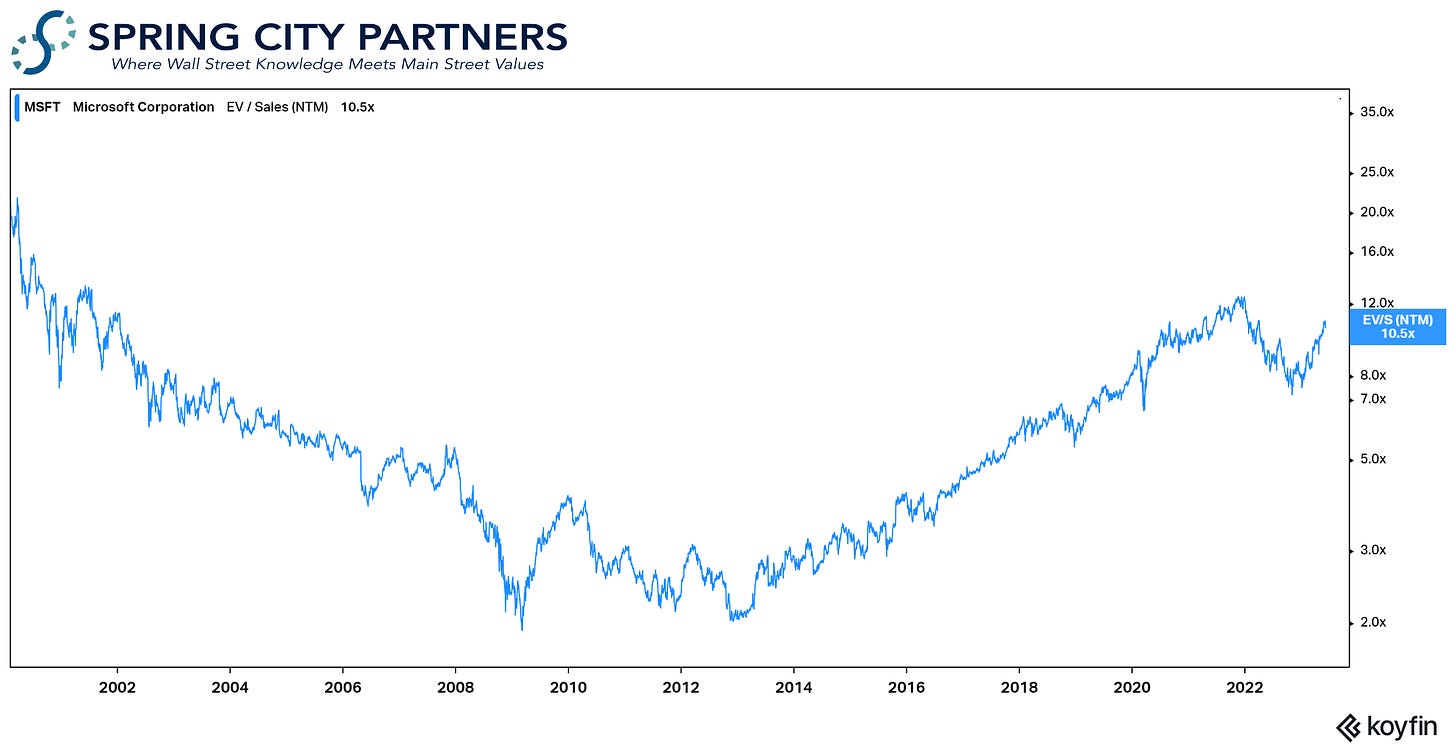

In my 2020 Letter to Investors I used Microsoft as an analogy to explain this dynamic -

When Microsoft was trading at ~3.0x Revenue in 2014 the odds were wrong. The oddsmaker, in this case the market, had mispriced the outcome. Since 2014 Microsoft generated ~$220b of Free Cash Flow compared to a beginning Enterprise Value of ~$300b. Today Microsoft has an Enterprise Value of $1,500b and generated ~$45b of Free Cash Flow in FY20.

Using our pari-mutuel example, Microsoft went from being the front runner in the dot-come era, to a longshot, and now back to a front runner.

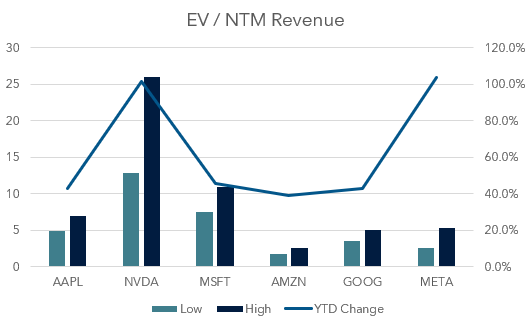

This analogy resonates with my current thoughts on the market. We are witnessing a small group of highly consensus stocks, particularly within the AI theme, generating nearly 100% of the year-to-date returns. The market has significantly elevated the valuations of these companies, ranging from 40% to 100% thus far in 2023. Drawing from our horse racing analogy, these stocks are undoubtedly the overwhelming betting favorites.

After such a dramatic change in valuation AND high multiple the market is incorporating numerous future expectations into the present price. Maybe the market is right? It is plausible that the growth prospects for these few stocks are bound to generate substantial profits for shareholders. However, given their current valuations, they cannot afford any upsets. Conversely, many stocks in the market are trading as the longest of long shots. For them to payoff from here they merely need to Show, not Win the race.

Enjoy the weekend.

Bill